APY Calculator

Atal Pension Yojana Calculator - APY Calculator is a tool that helps you to determine the interest received on investment in the Atal pension scheme.

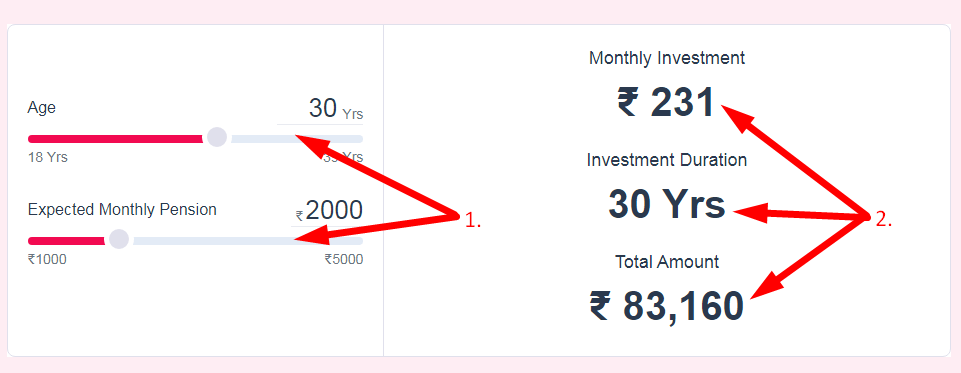

Monthly Investment

Investment Duration

Total Amount

How to use this APY Calculator Tool?

How to use Yttags's APY Calculator?

- Step 1: Select the Tool

- Step 2: Enter The Following And Check Your APY Calculator Result

Atal Pension Yojana calculator is an online tool that is used to calculate the real returns an individual can expect if they are investing in the APY scheme.

If you want to link to Apy Calculator page, please use the codes provided below!

FAQs for APY Calculator

What is a APY Calculator?

An APY (Atal Pension Yojana) calculator is a tool that helps individuals in India plan for their retirement by estimating the pension amount they can receive based on their contributions, age, and the chosen pension scheme under the Atal Pension Yojana government initiative.

Is APY calculated annually?

APY is the percentage rate of return on your money over one year, and it includes compound interest. The interest may be compounded daily, monthly, or yearly, depending on the deposit account.

How is APY calculated on a monthly basis?

It's easy. Simply divide your APY by 12 (for each month of the year) to find the percent interest your account earns per month. For example: A 12% APY would give you a 1% monthly interest rate (12 divided by 12 is 1).

How do you calculate profit from APY?

The formula for determining how much you'll earn with a particular APY looks like this: (APY x principal) + principal = total earnings after a year. In our example, let's say you have an $80,000 principal balance in your savings account. The APY, remember, we've already calculated to be 0.060017%.

How do you calculate daily interest from APY?

Your daily periodic interest can be calculated by dividing your Annual Percentage Rate (APR) by the number of days that are taken into account for the year, this is typically 360 or 365 days depending on your credit card issuer.