Dividend Yield Calculator

Dividend yield Calculator - Calculate dividend Yield in percentage by simply entering dividend earned & share price using Free Online Dividend Yield Calculator.

Result

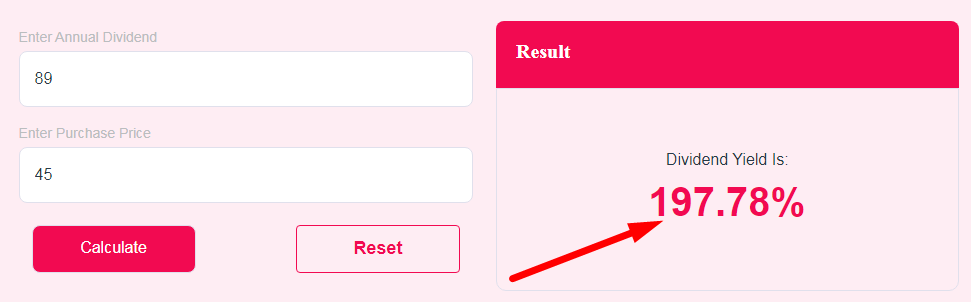

Dividend Yield Is:

How to use this Dividend Yield Calculator Tool?

How to use Yttags's Dividend Yield Calculator?

- Step 1: Select the Tool

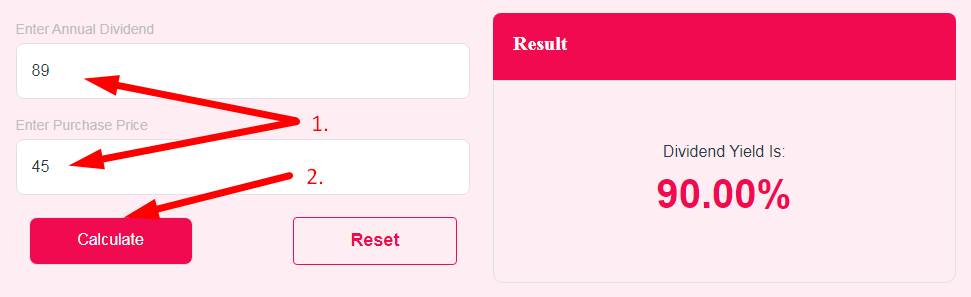

- Step 2: Enter The Following Options And Click On Calculate Button

- Step 3: Check Your Dividend Yield Calculator Result

Use our dividend yield calculator to quickly and easily calculate the dividend yield of a stock. Simply enter the dividend per share and the share price, and our calculator will do the rest.

If you want to link to Dividend Yield Calculator page, please use the codes provided below!

FAQs for Dividend Yield Calculator

What is a Dividend Yield Calculator?

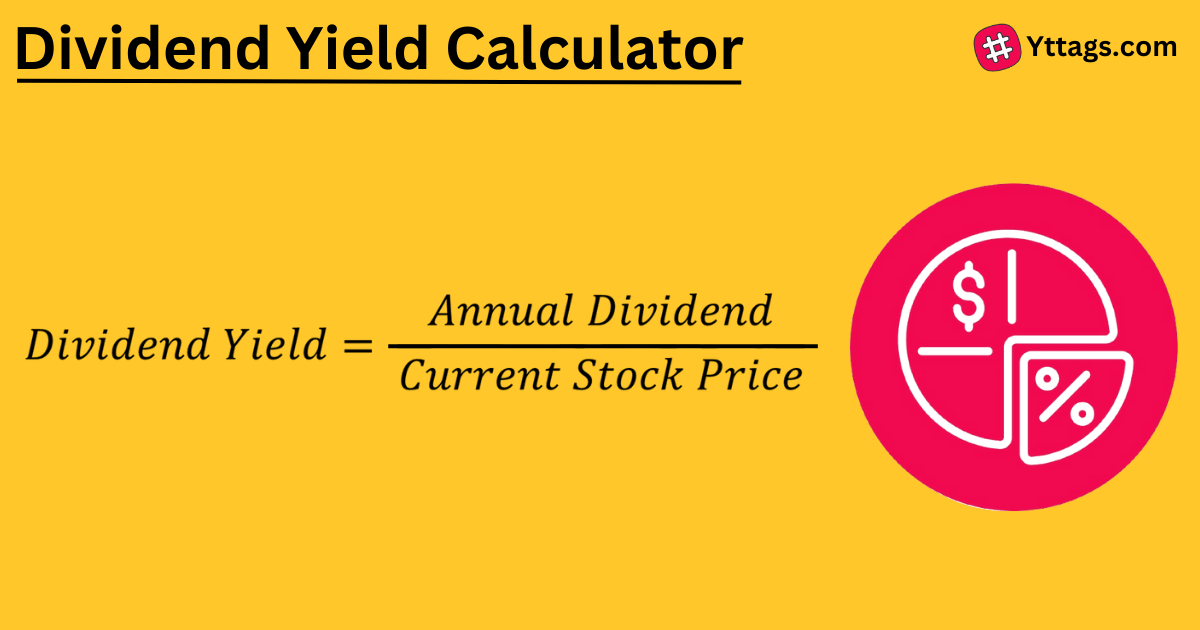

A Dividend Yield Calculator is a tool that calculates the dividend yield of a stock by dividing its annual dividend payment by its current market price, providing investors with a percentage representing the return on investment from dividends.

How dividend yield is calculated?

To calculate dividend yield, all you have to do is divide the annual dividends paid per share by the price per share. For example, if a company paid out around INR 412 in dividends per share and its shares currently cost INR 12,370, its dividend yield would be 3.33%.

How do you calculate dividend yield on a calculator?

To calculate a stock's dividend yield, all you need to do is divide the stock's annual dividend by its current share price. This value gives you the amount of money the stock's dividend pays out on every dollar invested in the stock.

How much is a 4% dividend yield?

For example, suppose an investor buys $10,000 worth of a stock with a dividend yield of 4% at a rate of a $100 share price. This investor owns 100 shares that all pay a dividend of $4 per share (100 x $4 = $400 total).

What is 5% dividend rule?

The distributions are paid in fractions per existing share. For example, if a company issues a stock dividend of 5%, it will pay 0.05 shares for every share owned by a shareholder. The owner of 100 shares would get five additional shares.