EBITDA Calculator

This EBITDA calculator helps you understand your business's key revenue metrics and EBITDA formula.

Try our free EBITDA calculator now!

EBITDA Margin:

0%

EBITDA Margin

Total Operating Expenses

How to use this EBITDA Calculator Tool?

How to use Yttags's EBITDA Calculator?

- Step 1: Select the Tool

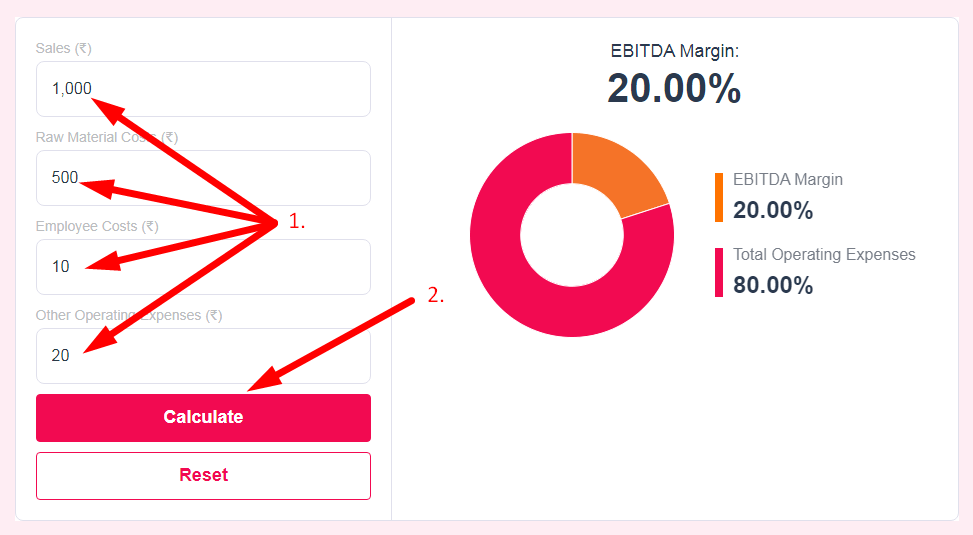

- Step 2: Enter The Following Options And Click On The Calculate Button

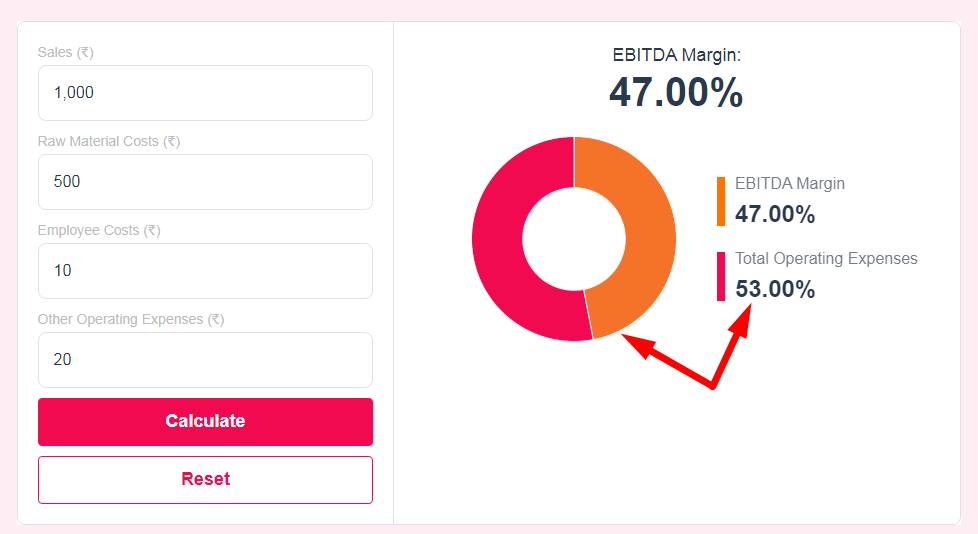

- Step 3: Check Your EBITDA Calculator Result

The EBITDA calculator is a tool that helps you calculate EBITDA – a business indicator that has been made to measure the operating profit of a company.

If you want to link to Ebitda Calculator page, please use the codes provided below!

FAQs for EBITDA Calculator

What is a EBITDA Calculator?

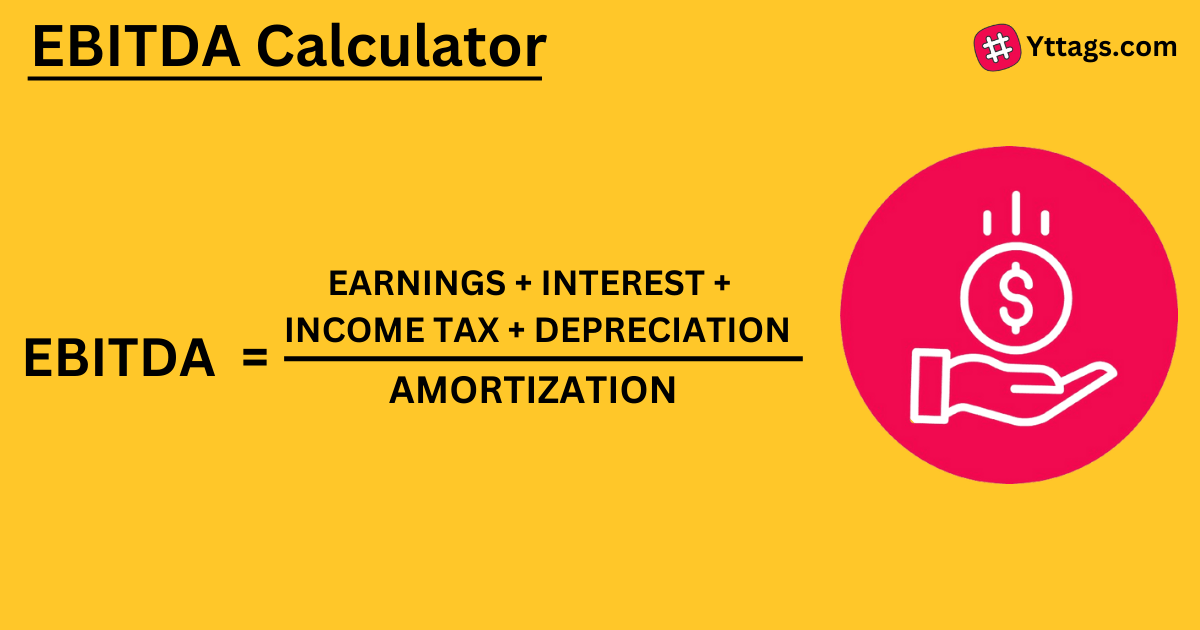

An EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) calculator is a financial tool used to assess a company's operating performance by calculating its profitability before certain non-operating expenses are accounted for.

What are the limitations of EBITDA?

EBITDA can be artificially inflated by non-cash items such as depreciation and amortization, which do not impact a company's cash flow (although they do represent a level of capital spending that may be required which is a cash outflow).

What is the purpose of the EBITDA?

EBITDA indicates how well the company is managing its day-to-day operations, including its core expenses such as the cost of goods sold. As such, it is a very fair indicator of a business's current state and potential. In some cases, it is much fairer than either gross profit or net income.

When not to use EBITDA?

The reason these issues matter is that EBITDA removes real expenses that a company must actually spend capital on – e.g. interest expense, taxes, depreciation, and amortization. As a result, using EBITDA as a standalone profitability metric can be misleading, especially for capital-intensive companies.

What income is excluded from EBITDA?

Interest expense is excluded from EBITDA, as this expense depends on the financing structure of a company. Interest expense comes from the money a company has borrowed to fund its business activities. Different companies have different capital structures, resulting in different interest expenses.