EPF Calculator

Employee Provident Fund Calculator: calculate your employers provident fund amount with our EPF calculator after your retirement.

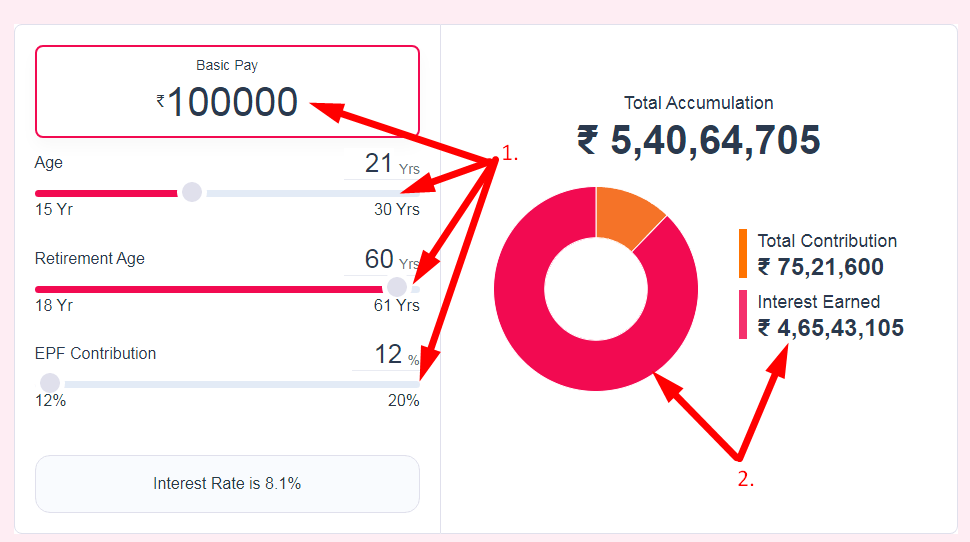

Total Accumulation

0

Total Contribution

Interest Earned

How to use this EPF Calculator Tool?

How to use Yttags's EPF Calculator?

- Step 1: Select the Tool

- Step 2: Enter The Following Options And Check Your EPF Calculator Result

EPF or PF Calculator reflects the amount of money that you will have in your Employee Provident Fund account during retirement. Check out the EPF calculator at Yttags.

If you want to link to Epf Calculator page, please use the codes provided below!

FAQs for EPF Calculator

What is a EPF Calculator?

An EPF (Employee Provident Fund) calculator is a financial tool that helps employees in India estimate their provident fund savings over time, considering factors such as monthly contributions, interest rates, and the duration of the investment period.

On which amount EPF is calculated?

You and your employer need to transfer 10% or 12% of your basic salary to contribute towards EPF. However, if you are a woman, you only need to contribute 8% of your basic salary for the first three years. During this period, your employer's EPF contribution will remain 12%.

How much can I withdraw from EPF calculator?

Irrespective of the last drawn salary, the maximum salary considered for this calculation is Rs 15,000. Therefore, if your last drawn salary is Rs 42,000 and you have worked for eight consecutive years, the EPS amount you can withdraw is Rs 15,000 * 8.22 = Rs 1,23,300.

Is EPF interest calculated monthly?

The EPF contribution is credited to the EPF account on a monthly basis, and interest is computed every month. However, the total interest for the year will be credited at the end of the financial year.

What is the 12% rule of EPF?

What is the rule for PF contribution? A monthly salary contribution of 12% is made to the Employee Provident Fund (EPF) by both the employee and the employer. Employees are not obligated to match employer contributions of up to 12% of their income, although they are able to do so voluntarily.