FD Calculator

Easily compute fixed deposit interest rates and maturity online with our FD Calculator. Fixed deposit calculator assists in computing the maturity and interest you can accrue from your fixed deposit investment.

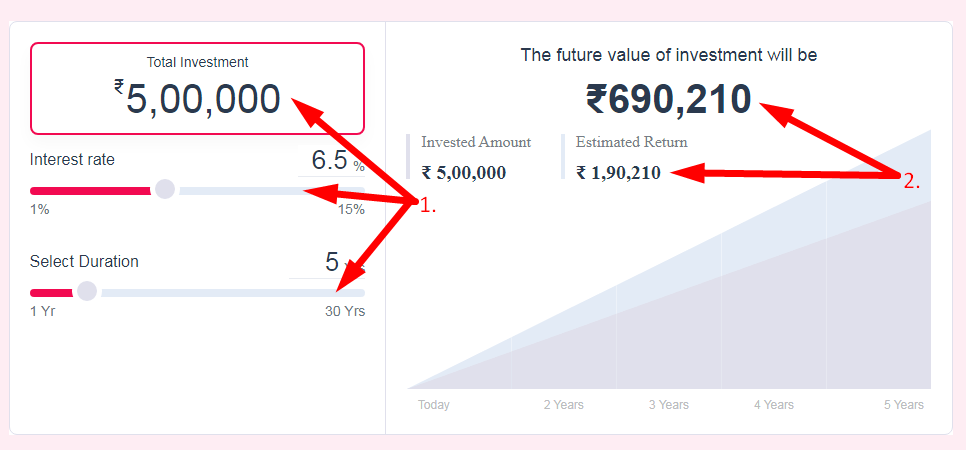

The future value of investment will be

Invested Amount

₹ 0

Estimated Return

₹ 0

How to use this FD Calculator Tool?

How to use Yttags's FD Calculator?

- Step 1: Select the Tool

- Step 2: Enter The Following Options And Check Your FD Calculator Result

FD Calculator - Calculate fixed deposit interest rates and maturity amount online at yttag.com. Fixed deposit calculator helps you to calculate the maturity and interest amount you can earn on your fixed deposit investment.

If you want to link to Fd Calculator page, please use the codes provided below!

FAQs for FD Calculator

What is a FD Calculator?

An FD (Fixed Deposit) Calculator is a financial tool used to determine the maturity amount and interest earned on a fixed deposit investment based on the principal amount, interest rate, and tenure.

What is the formula for calculating FD?

The fixed deposit maturity amount is calculated by the formula MV = (P x r x t)/100, in which MV is the maturity value; P is the principal amount deposited; r is the rate of interest; and t is the duration or the tenure of the FD.

What is the benefit of FD calculator?

You can use the FD calculator to determine the maturity amount of your fixed deposit. Interest rates vary according to the type of FD you choose, i.e. cumulative/ non-cumulative and the tenor. This FD interest calculator helps you determine the maturity amount in less than a minute.

What is the rule of FD?

You will keep earning interest on these deposits. Banks allow the premature withdrawal of fixed deposits as well. However, you will be charged a penalty for the same. The penalty charged for the premature withdrawal of a fixed deposit is generally 1% - 2%, however, this varies from one bank to another.

What is FD maturity value?

The maturity amount or value in a fixed deposit is the sum of your invested principal amount along with your interest earnings. These earnings are based on the predetermined FD interest rates and the chosen tenor.