Gratuity Calculator

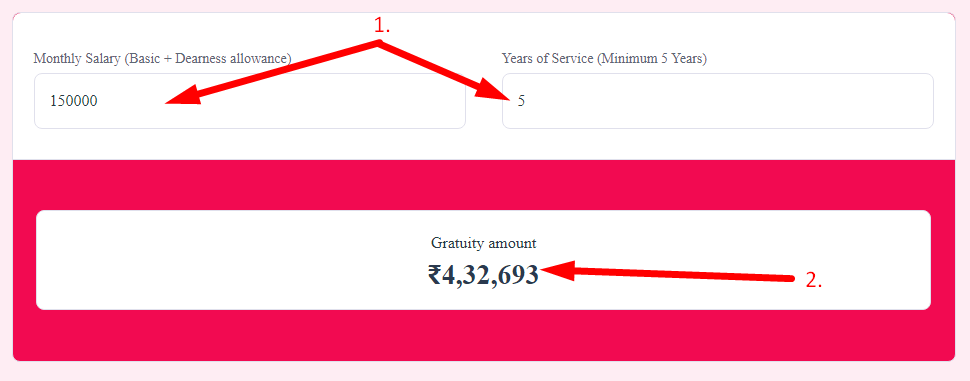

Gratuity Calculator - Check Online Gratuity by entering Salary & Years of Service to get the receivable amount when you leave your job.

Gratuity amount

How to use this Gratuity Calculator Tool?

How to use Yttags's Gratuity Calculator?

- Step 1: Select the Tool

- Step 2: Enter The Following Options And Check Your Gratuity Calculator Result

Gratuity Calculator: Use Our online gratuity calculator to know gratuity amount of money you will get on retirement. Only those employees who have been employed by the company for five years or more are given the gratuity. Check out gratuity formula, percentage, eligibility, rules in India.

If you want to link to Gratuity Calculator page, please use the codes provided below!

FAQs for Gratuity Calculator

What is a Gratuity Calculator?

A Gratuity Calculator is a tool that helps employees and employers in India estimate the gratuity amount payable to an employee based on factors such as years of service and last drawn salary, in accordance with the Payment of Gratuity Act.

What is new rule of gratuity calculation?

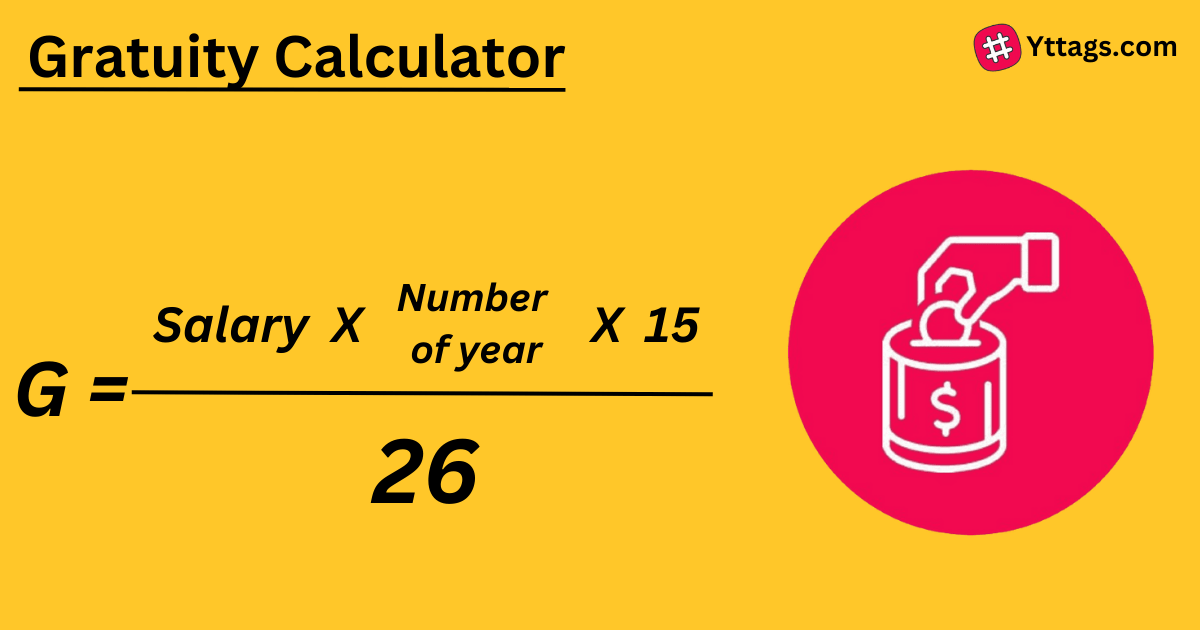

As per the new rule of gratuity, every year of service, an employee is entitled to 15 days of pay as gratuity. The company is required to pay an amount equal to 15 days of the employee's most recent wage as part of the gratuity for each year of service.

What is the criteria for calculating gratuity?

The formula is: (15 * Your last drawn salary * the working tenure) / 30. For example, you have a basic salary of Rs 30,000. You have rendered continuous service of 7 years and the employer is not covered under the Gratuity Act. Gratuity Amount = (15 * 30,000 * 7) / 30 = Rs 1,05,000.

How many days are used in the calculation of gratuity?

Even if the organisation is not covered under the Gratuity Act, the employees would still receive the Gratuity amount. But the number of days will be changed from 26 to 30 days. The Gratuity calculation formula is: Gratuity = (15 × last drawn salary × working tenure)/30.

What is the exemption of gratuity?

If any employee receives gratuity during his service, then it is fully taxable as income in his hands under the Income Tax Act, 1961 ('the Act'). However, if gratuity is received in case of death, retirement or resignation and certain other cases, then tax exemption is provided under section 10(10) of the Act.