HRA calculator

House Rent Allowance (HRA) Calculator - Now find House Rent Allowance Online easily by entering basic salary, dearness allowance, etc.

Taxable HRA

0%

Taxable HRA

Exempted HRA

How to use this HRA calculator Tool?

How to use Yttags's HRA calculator?

- Step 1: Select the Tool

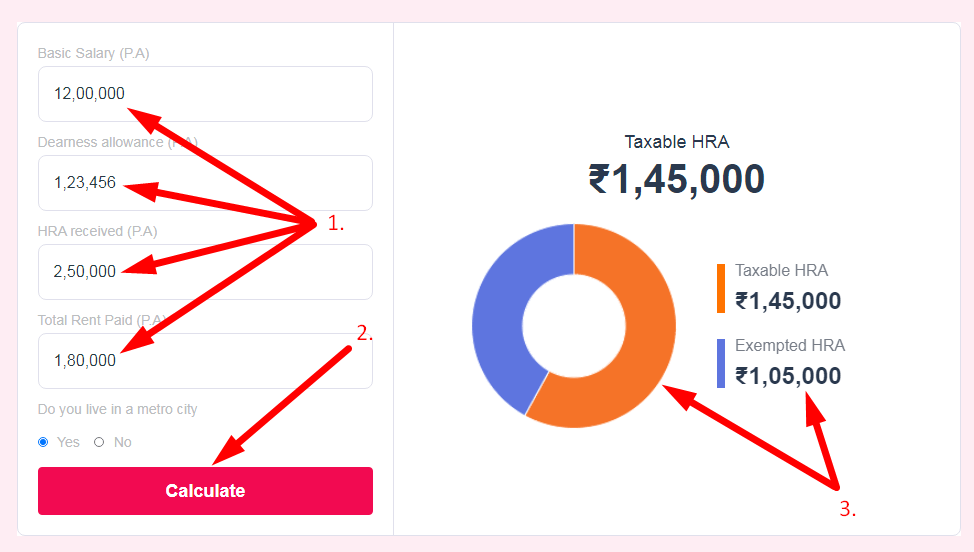

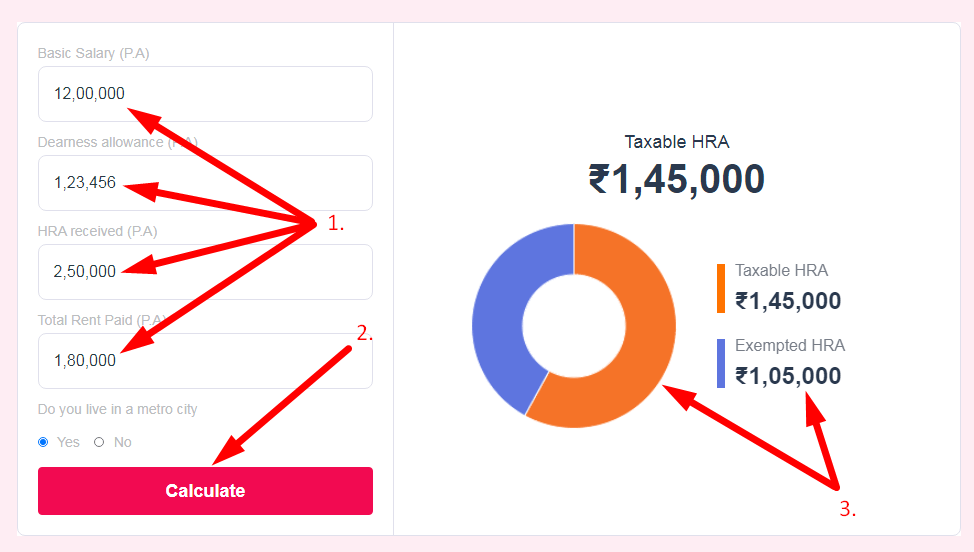

- Step 2: Enter The Following Options And Click On The Calculate Button

- Step 3: Check Your HRA calculator Result

File Income Tax Returns online. Yttags is fast, safe and very easy to use. Save money. Yttags handles all cases of Income from Salary, Interest Income, Capital Gains, House Property, Business and Profession. Yttags maximize your deductions by handling all deductions under Section 80 like section 80C, 80D, 80CCF, 80G, 80E, 80U and the rest.You can use your digital signature to e-file. Our products are trusted by hundreds of CAs and corporations for filing taxes and TDS.

If you want to link to Hra Calculator page, please use the codes provided below!

FAQs for HRA calculator

What is a HRA calculator?

An HRA (House Rent Allowance) calculator is a tool that assists individuals in computing the tax exemption on their rental housing expenses, considering factors such as salary, actual rent paid, and the city of residence, in accordance with the tax regulations in a particular country, like India.

What are the criteria for calculating HRA?

HRA received from your employer. Actual rent paid minus 10% of salary. 50% of basic salary for those living in metro cities. 40% of basic salary for those living in non-metro cities.

What is the relationship between HRA and basic salary?

The House Rent Allowance (HRA) amount allotted by the employer. 50% of the employee's basic salary, if s/he is staying in a metro city (40% for non-metro cities).

How is HRA calculated on monthly basis?

Actual rent paid minus 10% of the basic salary, or. Actual HRA offered by the employer, or. 50% of salary when residential house is situated in Mumbai, Delhi, Chennai or Kolkata; 40% of salary when residential house is situated elsewhere.

What are the new rules for HRA?

The rates of HRA will be revised to 27%, 18% and 9% for X,Y & Z class cities respectively when Dearness Allowance (DA) crosses 25% and further revised to 30%, 20% and 10% when DA crosses 50%.