Free online Mortgage Calculator

Use our Free A Mortgage Loan Calculator: to estimate your monthly Semi-Monthly, Bi-Weekly and Weekly mortgage payments. ⇒ Try it yourself!

Mortgage Calculator

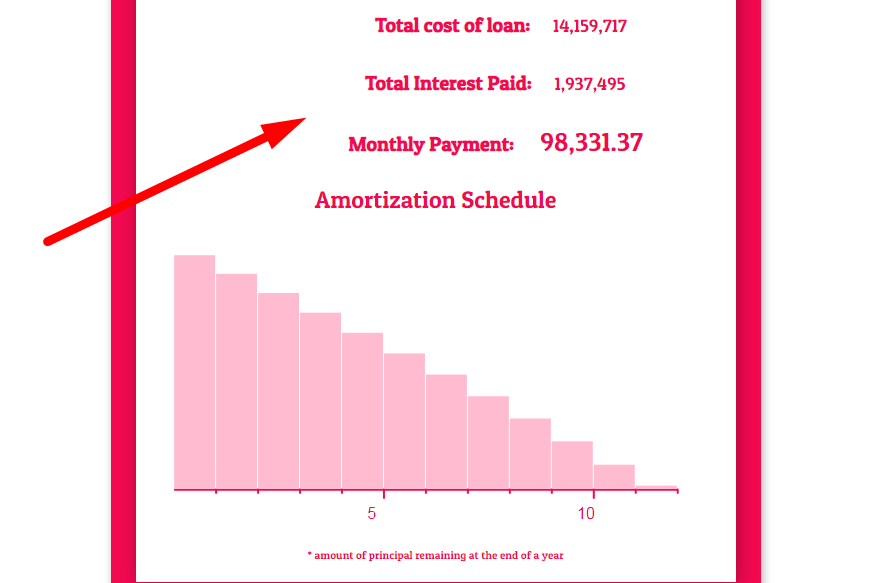

Amortization Schedule

Principal: {{ graphSelection.principal }}

Remaining: {{ graphSelection.principalPercent }}

How to use this Mortgage Calculator Tool?

How to use Yttags's Free online Mortgage Calculator?

- Step 1: Select the Tool

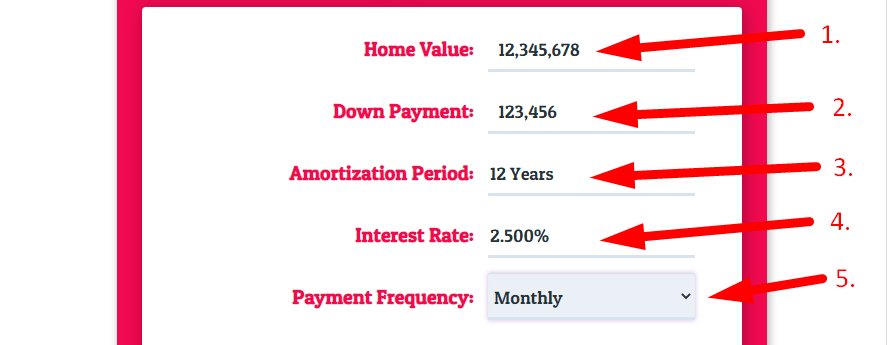

- Step 2: Enter The Values

- Step 3: Check Your Free online Mortgage Calculator Result

About Mortgage calculator

The mortgage calculator provides estimates for both the monthly payment required and other related financial charges. The calculator is primarily meant for use by Americans.

Mortgages

A mortgage is a loan that is backed by real estate, typically. It is described by lenders as credit taken out to purchase real estate. In essence, the buyer promises to repay the money borrowed over a set length of time—typically 15 or 30 years in the United States—while the lender assists the buyer in paying the home seller. The buyer makes a payment to the lender each month. The original amount borrowed is referred to as the principal and is represented by a portion of the monthly payment. The cost incurred by the lender in using the funds, or interest, makes up the remaining amount. Escrow accounts may be used to pay for the price of insurance and property taxes.

Until the last monthly payment is made, the buyer cannot be regarded as the legal owner of the mortgaged property. The standard 30-year fixed-interest loan, which accounts for 70% to 90% of all mortgages in the United States, is the most popular type of mortgage loan. In the United States, mortgages are the most common method of home ownership.

Components of mortgage calculators

The following essential elements are typically included in mortgages. These are the fundamental elements of a mortgage calculator as well.

The sum borrowed from a bank or lender is known as the loan amount. This is the purchase price less any down payment on a mortgage. Normal correlations between the maximum loan amount and household income or affordability exist. Please use our House Affordability Calculator to determine an affordable cost.

The down payment is the initial payment for a purchase, which is often a proportion of the entire cost. This is the sum of the purchase price that the borrower has paid. Usually, mortgage lenders require a 20% down payment or more from the borrower. Borrowers may occasionally put down as little as 3%. The borrowers will be obliged to pay private mortgage insurance (PMI) if their down payment is less than 20%. As long as the loan balance is above 80% of the home's initial purchase price, borrowers must maintain this insurance. The bigger the down payment, the more favourable the interest rate and the more probable the loan would be authorised, according to a general rule of thumb.

Loan term: The time period during which the loan must be fully repaid. A lower interest rate is often included with a shorter time frame, such 15 or 20 years.

the portion of the loan that is charged as interest as a cost of borrowing. Fixed-rate mortgages (FRM) and adjustable-rate mortgages (ARM) are the two types of mortgages available. The FRM loan's term's interest rates are fixed, as the name suggests. The calculator up top only computes fixed rates. For ARMs, interest rates are typically fixed for a while before being changed frequently after that based on market indexes and adjusted. ARMs let borrowers take on a portion of the risk. As a result, for the same loan term, the beginning interest rates are typically between 0.5% and 2% lower than FRM. It is the interest rate represented as a periodic rate times the quantity of annual compounding periods. For instance, if a mortgage rate is 6% APR, the borrower will be required to pay 0.5% in interest per month by dividing 6% by twelve.