NPV Calculator

Calculate the Net Present Value (NPV) of a project, or investment with our easy to use multi-scenario NPV calculator and guide.

Years/Periods Required

Scenario 1

Discount Rate

Initial Investment

Net Present Value (NPV)

%

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

Scenario 2

Discount Rate

Initial Investment

Net Present Value (NPV)

%

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

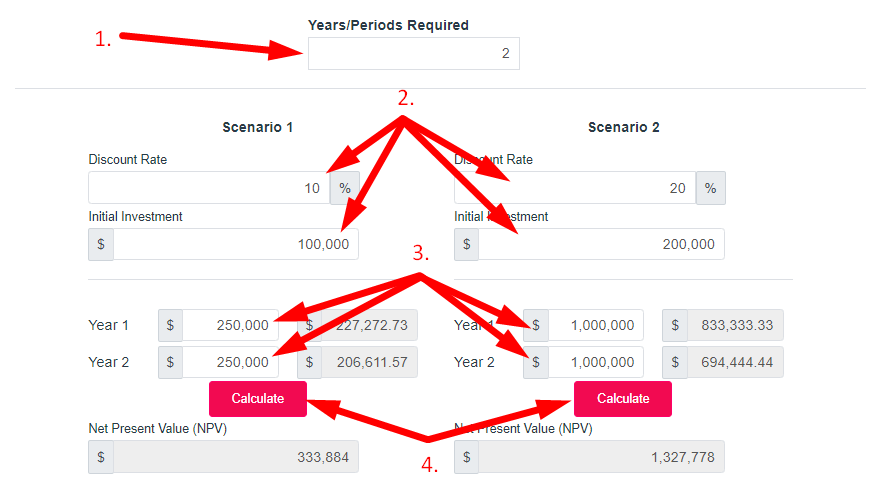

How to use this NPV Calculator Tool?

How to use Yttags's NPV Calculator?

- Step 1: Select the Tool

- Step 2: Enter The Following Value And Check Your NPV Calculator Result

Calculate the Net Present Value (NPV) for an investment based on initial deposit, discount rate and investment term. ➤ Net Present Worth calculator, NPV formula and how to determine NPV/NPW. Also calculates Internal Rate of Return (IRR).

If you want to link to Npv Calculator page, please use the codes provided below!

FAQs for NPV Calculator

What is a NPV Calculator?

An NPV (Net Present Value) calculator is a financial tool used to assess the profitability of an investment by calculating the present value of its expected cash flows, taking into account the time value of money.

What should not be included in NPV calculation?

Sunk costs, which are costs that have already been incurred and cannot be recovered, should not be included in NPV calculations. Only future cash flows relevant to the investment decision should be considered.

How do you find the NPV without discount rate?

You cannot calculate NPV without a discount rate. The discount rate is a critical component of NPV calculations as it accounts for the time value of money by determining the present value of future cash flows.

When should NPV not be used?

NPV should not be used as the sole criterion for investment decisions when comparing mutually exclusive projects with significantly different scales, as it may favor smaller projects with higher NPVs. In such cases, alternative metrics like the profitability index or internal rate of return (IRR) should also be considered.

What cash flows are not included in NPV?

Sunk costs, which are costs that have already been incurred and cannot be recovered, as well as financing costs such as interest expenses, are not included in NPV calculations. Only relevant future cash flows related to the investment should be considered.