ROI Calculator

Free return on investment (ROI) calculator calculates investment and the related returns.

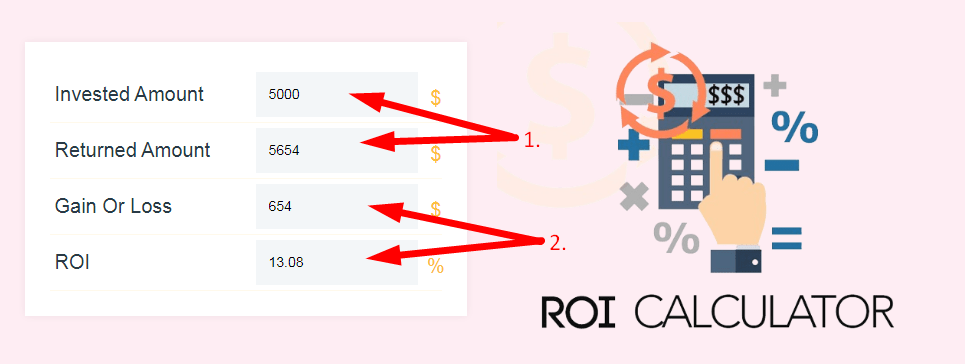

Just enter the amount invested, the amount returned and the duration.

Invested amount

You have to invest some money!

$

Returned amount

$

Gain or loss

$

ROI

%

How to use this ROI Calculator Tool?

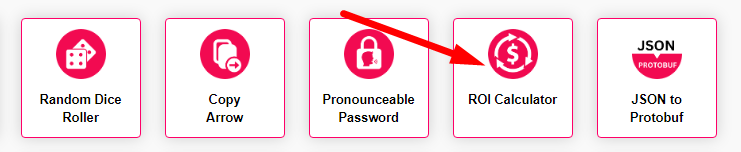

How to use Yttags's ROI Calculator?

- Step 1: Select the Tool

- Step 2: Enter The Following Options And Check Your ROI Calculator Result

An easy to use ROI calculator you can use to learn the expected return on investment over time - usually years. ➤ This free ROI calculator calculates both overall ROI and annualized ROI. ROI formula, examples for calculating return on investment, calculating annualized return, and more.

If you want to link to Roi Calculator page, please use the codes provided below!

FAQs for ROI Calculator

What is a ROI Calculator?

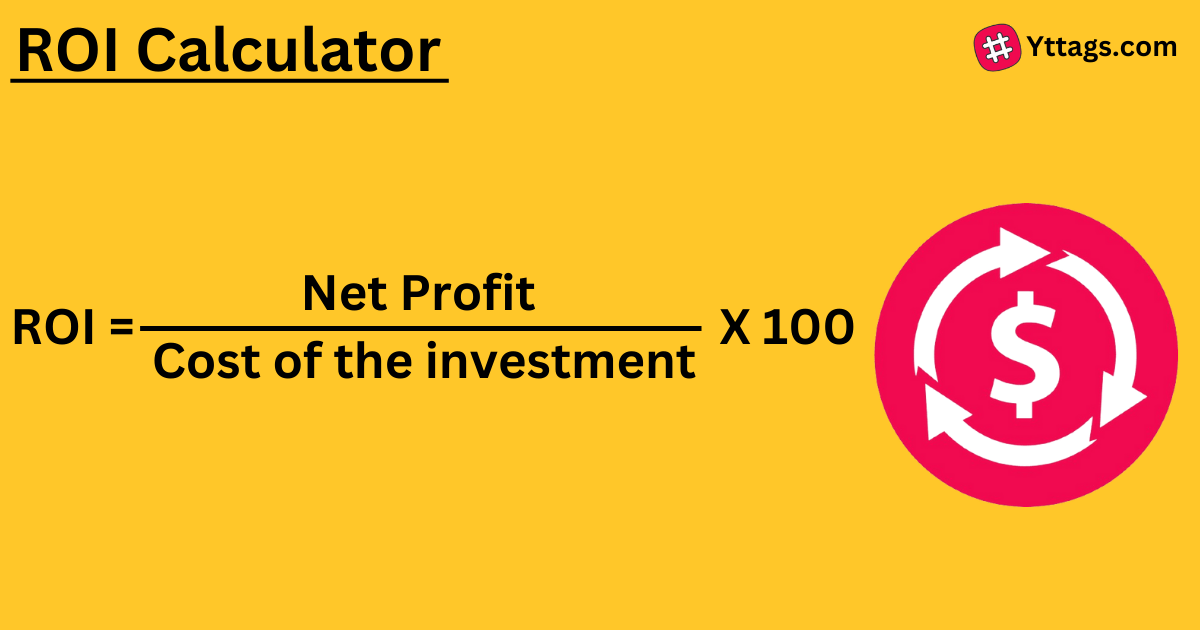

A ROI (Return on Investment) calculator is a financial tool that helps assess the profitability of an investment by calculating the ratio of net profit or gain to the initial cost or outlay, expressed as a percentage.

What to consider when calculating ROI?

Return on investment is typically calculated by taking the actual or estimated income from a project and subtracting the actual or estimated costs. That number is the total profit that a project has generated, or is expected to generate. That number is then divided by the costs.

What does the ROI calculator calculate?

ROI is expressed as a percentage and is calculated by dividing an investment's net profit (or loss) by its initial cost or outlay. ROI can be used to make apples-to-apples comparisons and rank investments in different projects or assets.

What is a successful ROI?

The rule of thumb for marketing ROI is typically a 5:1 ratio, with exceptional ROI being considered at around a 10:1 ratio. Anything below a 2:1 ratio is considered not profitable, as the costs to produce and distribute goods/services often mean organizations will break even with their spend and returns.

What is the period of ROI?

ROI is often compared to expected (or required) rates of return on money invested. ROI is not time-adjusted (unlike e.g. net present value): most textbooks describe it with a "Year 0" investment and two to three years' income.