Stripe Fee Calculator

How to use this Stripe Fee Calculator Tool?

How to use Yttags's Stripe Fee Calculator?

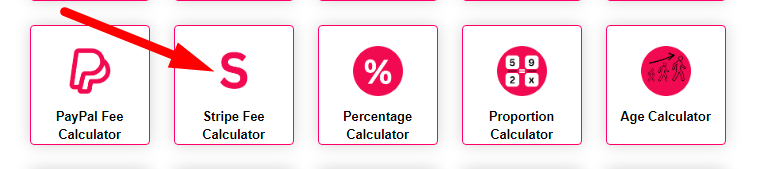

- Step 1: Select the Tool

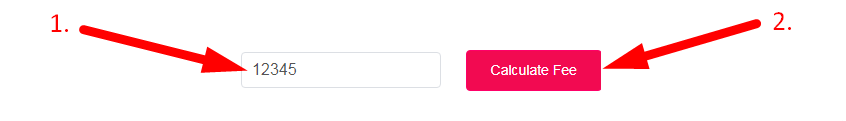

- Step 2: Enter The Amount And Click on Calculate Fee Button

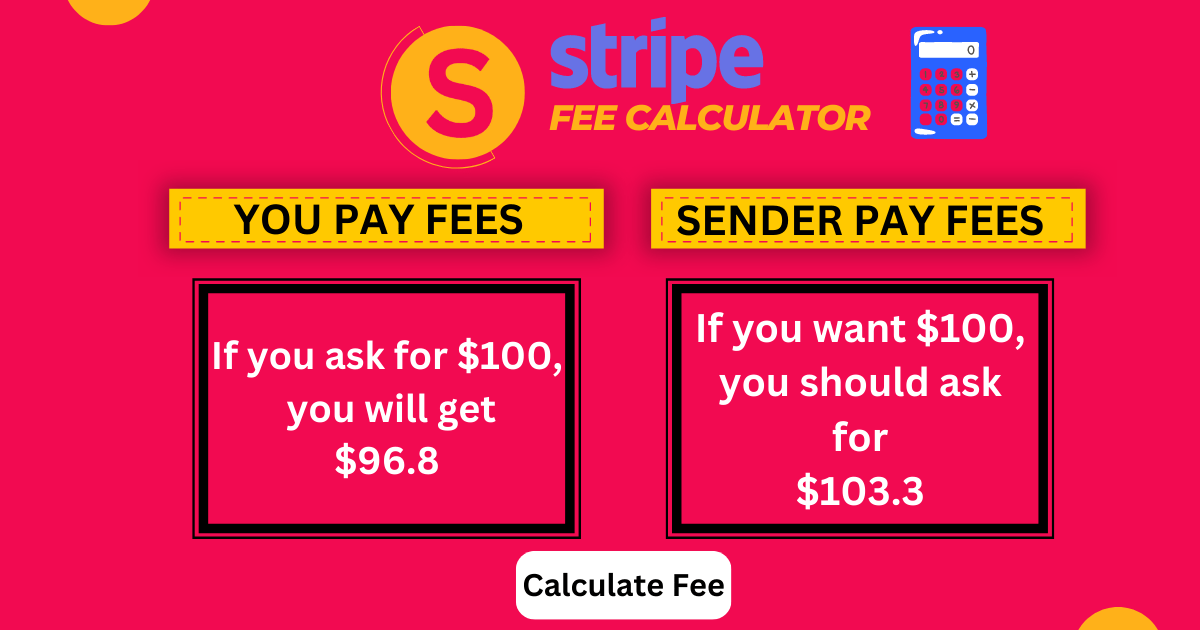

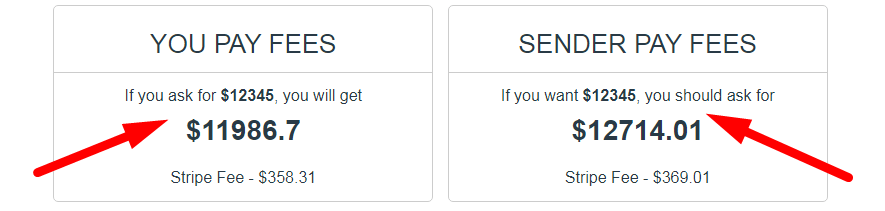

- Step 3: Check Your Stripe Fee Calculator Result

About Knowing Stripe Fees

A well-known platform for processing payments online called Stripe was created to make it easier for businesses of all kinds to take payments, handle their finances, and increase sales. Although Stripe has a point-of-sale system called Stripe Terminal for in-person transactions, it is best for companies who take online payments. Utilising Stripe has a number of advantages, one of which is its simple pricing structure, which consists of a percentage fee and/or a flat fee.

Our calculator makes use of Stripe's 2.9% plus $0.30 per transaction fee for online payments and digital wallets. Enter your transaction amount to find out how much Stripe will charge, how much you'll keep, and how much you should charge to cover the fees.

How to Cut Stripe Charges?

Both you and your clients shouldn't have to forfeit hard-earned cash due to Stripe fees! Here are some strategies for avoiding or lowering Stripe fees:

1. Request specific prices

For less expensive transaction costs, you can ask the Stripe sales team about custom rates for your company.

2. Increase your Stripe plan's tier

Although it may seem paradoxical, if you send a lot of invoices each month, spending more for a monthly plan and forgoing the hefty percentage costs imposed on each transaction may actually save you money.

3. Combining payments

Work up a way to combine payments with repeat clients so you only have to pay the fixed costs once.

4. Use fee-free invoicing instead

You can send polished invoices to your clients and collect money without having to worry about extra costs thanks to yttag invoicing software!

What are the fees for Stripe?

The typical Stripe price for card and digital wallet transactions is 2.9% plus $0.30. Other Stripe transaction types are subject to extra costs. Standard Stripe costs for firms with U.S. locations include:

| Stripe Payments Feature | Percentage Fee | Fixed Fee |

|---|---|---|

| Online payments and digital wallets | 2.9% per transaction | $0.30 |

| In-person payments through Stripe Terminal | 2.7% | $0.05 |

| ACH Credit payments | None | $1 per ACH Credit payment |

| Wire payments | None | $8 per Wire payment |

| Check payments | None | $5 per check received |

| ACH Direct Debit payments | 0.8% per transaction (capped at $5) | None |

How to lower Stripe charges?

Use Yttag Stripe Perk:

Your first $5,000 in Stripe earnings is fee-free when you use Yttag Stripe Perk. Join to avoid transaction costs!

Combine payments:

Work with customers to combine payments if you bill them on a recurring basis to avoid paying fixed fees.

Utilise Stripe's fraud protection tools:

Stripe provides a number of tools, such as Radar, to help prevent fraud and lower the number of chargebacks and disputes.

Use Yttag Boost:

To get paid more quickly at no extra cost to you. Your account balance is immediately updated when you receive money from Stripe.

Transfer the cost to the customer:

By tacking on a surcharge to transactions, you may pass the cost on to your customers. Before using this tactic, be sure it's permitted in your country.

Use free invoicing software:

You can send an infinite number of invoices for free with Yttag. In addition to Square and PayPal, Yttag currently works with Stripe, allowing you to use your favourite payment processor to take credit card payments.