Yield to Maturity Calculator

Calculate the yield to maturity value of your bond investment with our easy to use calculator.

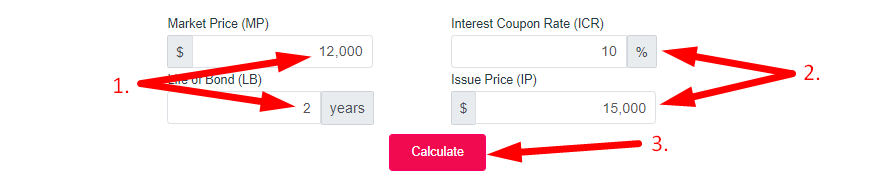

Market Price (MP)

Life of Bond (LB)

$

years

Interest Coupon Rate (ICR)

Issue Price (IP)

%

$

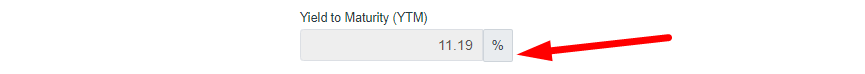

Yield to Maturity (YTM)

%

How to use this Yield to Maturity Calculator Tool?

How to use Yttags's Yield to Maturity Calculator?

- Step 1: Select the Tool

- Step 2: Enter The Following Value And Click On Calculate Button.

- Step 3: Check Your Yield to Maturity Calculator Result

If you want to link to Yield To Maturity Calculator page, please use the codes provided below!

FAQs for Yield to Maturity Calculator

What is a Yield to Maturity Calculator?

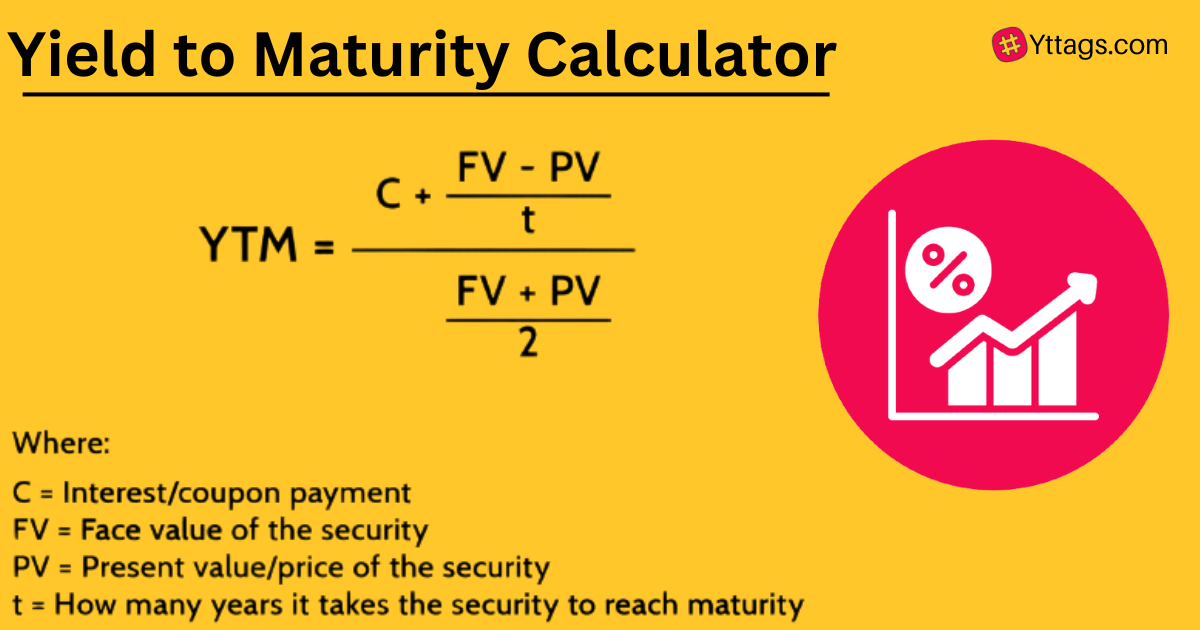

A Yield to Maturity (YTM) Calculator is a financial tool used to estimate the annual rate of return an investor can expect to receive from a bond or fixed-income investment, taking into account factors like its current market price, coupon interest rate, and the time to maturity.

Does yield to maturity change over time?

No, the yield to maturity (YTM) remains constant over time for a fixed-rate bond if held until maturity. However, the YTM may change for bonds with variable interest rates or if the bond is bought or sold in the secondary market at a different price than its face value.

How accurate is the yield to maturity?

The yield to maturity (YTM) is an estimate and assumes that the bond will be held until maturity, with coupon payments reinvested at the YTM rate. It may not account for changes in interest rates, issuer risk, or market conditions, so it provides a reasonably accurate estimate but not a guaranteed return.

Why is yield to maturity important?

Yield to maturity (YTM) is important because it provides investors with a way to assess and compare the potential returns of different fixed-income investments, helping them make informed decisions and understand the expected profitability of bonds.

Can yield to maturity be negative?

Yes, yield to maturity (YTM) can be negative if an investor pays a premium for a bond with a low coupon rate, and prevailing interest rates are significantly higher. In this scenario, the investor may receive less in coupon payments and face a capital loss upon maturity.